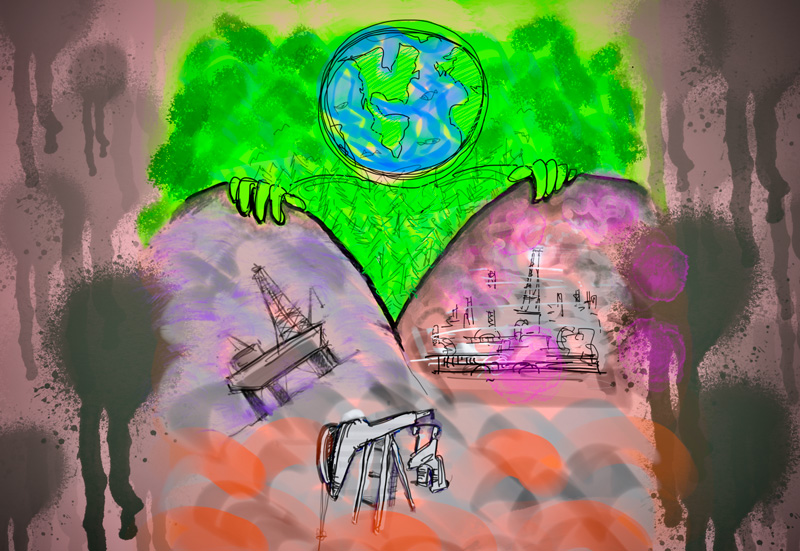

Kyoto, Japan -- Pledges to emit less greenhouse gases are laced with nuance. Are major oil companies -- the majors -- replacing fossil fuels as the dominant source of energy with cleaner alternatives, or are they merely playing poker with carbon currencies?

An international team of researchers led by Kyoto University has now conducted a first-ever study focusing on the transition and carbon-offsetting behavior of the majors. A database created for the project has been made publicly available to enhance the study's transparency.

"To measure each major's intent to transition, we applied indicators of their plans to phase out their supply of oil and gas and take responsibility for all lifecycle emissions," says Gregory Trencher of Kyoto University's Graduate School of Global Environmental Studies, referring to current clean energy investments that merely complement -- not replace -- fossil fuels.

Trencher's team investigated the behaviors of BP, Shell, Chevron, and ExxonMobil using a two-tiered analysis:

- Net-zero strategy: How does each major's net-zero plans for 2050 differ with respect to the scope of emissions covered, plans to downscale fossil-fuel production, and reliance on offsets?

- Offsetting behavior: What kinds of offsets are leveraged for decarbonization and profit generation? How are offsets linked to core business activities?

In addition, unlike other studies that have focused on plans to increase clean energy sources, Trencher's team has conducted an extensive analysis of the majors' offsetting behavior. With net zero, a company can purchase carbon credits from projects in developing countries, such as forest conservation energy, to claim it has reduced its own emissions.

The team reached two main conclusions from the two tiers of analysis, combining data obtained from each major's annual and sustainability reports and websites with offsetting data from the voluntary carbon market:

First, "Net-zero pledges by oil majors do not encompass a business-model transformation away from fossil fuels," comments coauthor Mathieu Blondeel of Vrije University Amsterdam. Absent are clear plans to curb both the production and sales of hydrocarbons and -- by reliance on carbon offsets -- to reach net-zero emissions and decarbonize conventional energy products.

Second, "Our results point to questionable climate benefits for offsets," adds Tohoku University coauthor Jusen Asuka, suggesting that most offset projects and carbon credits the majors use are for avoiding emissions rather than for physically removing emissions from the atmosphere.

These two findings challenge the authenticity of claims from the majors that have pledged to reach net-zero emissions by 2050 while transitioning to clean energy. Achieving this requires a dual-transformative process where hydrocarbon production is progressively downscaled and then eliminated at the same time that clean energy is rapidly scaled up.

"The majors tend to claim that ordinary fossil fuels are carbon-neutral by using carbon offsets to fast-track their progress towards net-zero targets," remarks Trencher.

"This is problematic," the lead author adds, pointing out that historical and recent evidence shows that many carbon-offset projects have overstated their climate benefits and are "unable to deliver on their promised ton-for-ton emissions compensation."

"Moreover," concludes Trencher, "with many credits coming from aged avoidance projects, our dataset shows that many offset projects do not support the physical removal of carbon emissions from the atmosphere today."

Credit: KyotoU/Jake Tobiyama

【DOI】 https://doi.org/10.1007/s10584-023-03564-7

Trencher, G., Blondeel, M. & Asuka, J. Do all roads lead to Paris?. Climatic Change 176, 83 (2023).